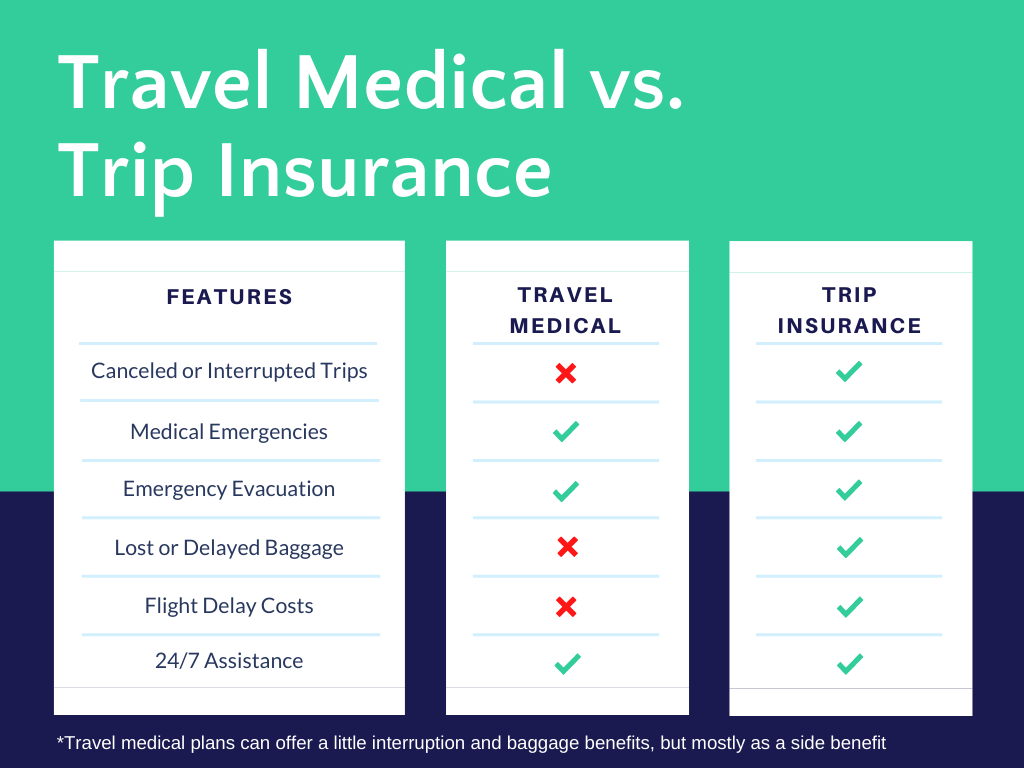

Travel And Trip Insurance insurance covers medical expenses, trip cancellations, lost baggage, and emergency evacuations, while trip insurance solely focuses on trip cancellations or interruptions. Travelers understand the importance of protecting their trips, and having the right insurance coverage can give them peace of mind.

When planning a journey, it’s essential to protect yourself against unexpected events that could disrupt your plans or affect your well-being. This is where travel insurance and trip insurance come into play. While these terms are often used interchangeably, they can refer to different types of coverage depending on the provider and policy specifics. Understanding the differences between them can help you choose the right protection for your needs.

Trip Insurance

What is Trip Insurance?

Trip insurance, also known as trip cancellation insurance or trip protection, is a type of insurance policy designed to reimburse you for non-refundable travel expenses if your trip is canceled, interrupted, or delayed due to covered reasons. It offers financial protection against unforeseen events that could prevent you from taking your trip as planned.

Key Coverages Offered by Trip Insurance

Trip insurance policies typically include several essential coverages:

1. Trip Cancellation

This coverage reimburses you for prepaid, non-refundable expenses if you need to cancel your trip before departure due to covered reasons such as:

- Illness or injury affecting you, a traveling companion, or a family member.

- Death of a family member or traveling companion.

- Natural disasters or severe weather conditions.

- Jury duty or being called to appear as a witness in court.

- Unforeseen employment termination or required work obligations.

- Terrorist incidents in your destination city.

2. Trip Interruption

If your trip is cut short due to covered reasons, trip interruption coverage reimburses you for the unused portion of your trip and additional expenses incurred to return home early.

3. Trip Delay

This coverage provides reimbursement for additional expenses such as accommodations, meals, and transportation if your trip is delayed for a specified number of hours due to reasons like severe weather, mechanical issues, or airline delays.

4. Missed Connection

If you miss a connecting flight or other transportation due to reasons beyond your control, this coverage helps pay for additional transportation costs to catch up to your trip.

5. Baggage Loss and Delay

This protects against the loss, theft, or damage of your luggage and personal belongings during your trip. It also provides reimbursement for essential items if your baggage is delayed for a certain period.

6. Emergency Assistance Services

Some trip insurance policies offer 24/7 assistance services to help you in emergencies, such as arranging alternative travel plans, locating lost luggage, or providing translation services.

When Should You Consider Trip Insurance?

Trip insurance is particularly beneficial in the following scenarios:

- Expensive or Prepaid Trips: If you’ve invested a significant amount of money in non-refundable travel arrangements like flights, cruises, or tour packages.

- Trips During Unpredictable Seasons: Traveling during times when weather-related disruptions are common, such as hurricane season.

- Health Concerns: If you or a family member have existing health issues that could potentially cause you to cancel your trip.

- Strict Cancellation Policies: When your travel bookings have stringent cancellation policies with little to no refunds.

- Group Travel: Coordinating trips for multiple people increases the chances that someone may need to cancel or alter plans.

What Trip Insurance Does Not Cover

It’s essential to understand that trip insurance policies have exclusions and limitations. Common exclusions include:

- Pre-Existing Medical Conditions: Unless you purchase a waiver, most policies won’t cover cancellations due to pre-existing health issues.

- Change of Mind: Deciding not to travel without a covered reason is typically not covered.

- High-Risk Activities: Some adventurous activities may not be covered unless you add specific riders to your policy.

- Travel to High-Risk Destinations: Some policies exclude coverage for travel to countries with travel advisories or warnings.

How to Choose the Right Trip Insurance Policy

When selecting a trip insurance policy, consider the following steps:

1. Assess Your Needs

- Trip Cost: Calculate the total non-refundable expenses you need to insure.

- Health Considerations: Consider any health issues that could affect your travel plans.

- Activities Planned: Identify any activities that may require additional coverage.

2. Compare Policies

- Coverage Options: Look for policies that offer the coverages most relevant to your trip.

- Exclusions and Limitations: Read the fine print to understand what is and isn’t covered.

- Cost: Compare premiums and ensure they fit within your budget.

3. Check Provider Reputation

- Reviews and Ratings: Research the insurance provider’s reputation and customer service record.

- Financial Stability: Ensure the provider is financially stable and capable of paying claims.

4. Understand the Claims Process

- Documentation Required: Know what documents you’ll need to file a claim.

- Timeframe: Understand how long it takes for claims to be processed and paid.

Definition:

Trip insurance, also known as trip cancellation insurance or trip protection, primarily covers financial losses related to specific travel arrangements. It is designed to reimburse you for non-refundable expenses if your trip is canceled or interrupted due to covered reasons.

Common Coverages:

- Trip Cancellation: Reimburses prepaid, non-refundable expenses if you cancel your trip before departure due to covered reasons such as illness, death in the family, or severe weather.

- Trip Interruption: Covers additional expenses if your trip is cut short due to covered reasons, including the cost of returning home early.

- Trip Delay: Provides reimbursement for additional expenses incurred due to significant delays in travel, such as accommodation and meals.

- Missed Connection: Covers expenses related to missing a connecting flight or other transportation due to reasons like weather or mechanical issues.

- Baggage Loss/Delay: Reimburses for lost, stolen, or delayed baggage and personal belongings during your trip.

When to Consider Trip Insurance:

- Expensive Trips: For trips with significant prepaid costs like cruises, tours, or international vacations.

- Strict Cancellation Policies: When your travel arrangements have strict or non-refundable cancellation policies.

- Short-Term Travel: Ideal for single trips rather than extended travel periods.

Travel Insurance

Travel Insurance: Comprehensive Protection for Your Journey

Traveling, whether for leisure, business, or adventure, can be an exciting and enriching experience. However, unforeseen events such as medical emergencies, trip cancellations, or lost baggage can turn a dream vacation into a stressful situation. Travel insurance is designed to provide comprehensive coverage for a wide range of risks associated with travel, offering peace of mind and financial protection when you need it most.

What is Travel Insurance?

Travel insurance is a type of insurance policy that covers various potential risks and financial losses associated with travel. Unlike trip insurance, which primarily focuses on protecting your financial investment in a specific trip, travel insurance provides broader coverage, including medical emergencies, trip disruptions, and other travel-related issues.

Key Coverages Offered by Travel Insurance

Travel insurance policies typically include several essential coverages, making them suitable for both domestic and international travel:

1. Medical Coverage

- Emergency Medical Expenses: Covers the cost of medical treatment if you become ill or injured while traveling. This is especially important if you’re traveling abroad, where your regular health insurance may not provide coverage.

- Emergency Medical Evacuation: Pays for transportation to the nearest adequate medical facility or back home if necessary due to a serious medical emergency.

- Repatriation of Remains: Covers the cost of returning your remains to your home country in the unfortunate event of death during your trip.

2. Trip Cancellation and Interruption

- Trip Cancellation: Reimburses you for non-refundable, prepaid trip costs if you have to cancel your trip before departure due to covered reasons, such as illness, natural disasters, or other unforeseen events.

- Trip Interruption: Provides reimbursement for the unused portion of your trip and additional expenses if your trip is cut short due to covered reasons.

3. Trip Delay

- Trip Delay Coverage: Compensates you for additional expenses incurred due to significant delays in your travel, such as accommodations, meals, and transportation.

4. Baggage and Personal Belongings

- Baggage Loss/Theft: Reimburses you for lost, stolen, or damaged baggage and personal belongings during your trip.

- Baggage Delay: Covers the cost of essential items if your baggage is delayed for a certain period.

5. Accidental Death and Dismemberment (AD&D)

- Accidental Death and Dismemberment: Provides a benefit in the event of death or serious injury (loss of limb or eyesight) due to an accident while traveling.

6. Travel Assistance Services

- 24/7 Emergency Assistance: Offers round-the-clock access to emergency services, such as medical referrals, legal assistance, and help with lost passports.

7. Rental Car Coverage

- Rental Car Damage: Covers costs associated with damage to a rental vehicle while you’re traveling, which can save you from having to purchase separate rental car insurance.

When Should You Consider Travel Insurance?

Travel insurance is particularly beneficial in the following scenarios:

- International Travel: Traveling abroad can involve significant medical and logistical risks, especially if you’re visiting countries with high healthcare costs or limited medical facilities.

- Expensive or Prepaid Trips: If you’ve invested a lot in non-refundable travel arrangements like flights, cruises, or accommodations.

- Adventure Travel: Engaging in activities such as skiing, scuba diving, or hiking, which may involve higher risks.

- Long-Term or Multiple Trips: For extended stays abroad or frequent travel, annual or multi-trip policies can provide continuous coverage.

- Remote or High-Risk Destinations: Traveling to areas with limited access to medical care or higher risks of natural disasters or civil unrest.

What Travel Insurance Does Not Cover

While travel insurance provides broad protection, it’s important to understand its limitations and exclusions. Common exclusions include:

- Pre-Existing Medical Conditions: Unless you purchase a waiver, most policies do not cover cancellations or medical expenses related to pre-existing conditions.

- High-Risk Activities: Certain adventurous or extreme sports may not be covered unless you add specific riders to your policy.

- Travel to High-Risk Destinations: Some policies exclude coverage for travel to countries with government-issued travel advisories or warnings.

- Routine Medical Care: Coverage is typically for emergencies only and does not include routine check-ups or non-urgent medical care.

- Voluntary Cancellations: Canceling a trip for reasons not covered by the policy (e.g., simply deciding not to go) is not typically reimbursed.

How to Choose the Right Travel Insurance Policy

Selecting the right travel insurance policy involves considering your specific travel needs and comparing different options:

1. Assess Your Needs

- Destination: Consider the healthcare quality, risks, and costs in the country you’re visiting.

- Trip Cost: Calculate the total non-refundable expenses and determine how much coverage you need.

- Health Considerations: If you have any medical conditions, check whether they can be covered or if a waiver is available.

- Activities: Identify any activities that may require additional coverage.

2. Compare Policies

- Coverage Options: Look for a policy that offers comprehensive coverage tailored to your travel plans.

- Exclusions: Carefully review the policy exclusions and limitations to ensure you understand what is not covered.

- Cost: Compare premiums to find a policy that fits your budget without compromising necessary coverage.

3. Check Provider Reputation

- Reviews and Ratings: Research the insurance provider’s reputation, including customer service and claims processing.

- Financial Stability: Ensure the provider is financially stable and has a good track record of paying claims.

4. Understand the Claims Process

- Documentation Required: Know what documents you’ll need to file a claim, such as receipts, medical reports, and proof of travel.

- Processing Time: Understand how long it takes for claims to be processed and paid.

Definition:

Travel insurance is a more comprehensive policy that includes not only the coverages found in trip insurance but also additional protections related to health and medical emergencies during your travels.

Common Coverages:

- All Trip Insurance Coverages: Includes trip cancellation, interruption, delay, missed connections, and baggage protection.

- Medical Expenses: Covers the cost of medical treatment if you become ill or injured while traveling.

- Emergency Medical Evacuation: Pays for transportation to the nearest adequate medical facility or back home in case of serious health issues.

- Accidental Death and Dismemberment (AD&D): Provides benefits in the event of death or loss of limb/vision due to an accident during your trip.

- 24/7 Assistance Services: Access to emergency assistance services, including help with lost passports, legal referrals, and medical referrals.

- Rental Car Damage: Covers costs associated with damage to a rental vehicle.

When to Consider Travel Insurance:

- International Travel: Especially to countries where your health insurance doesn’t provide coverage.

- Adventure Activities: If you plan to engage in activities like skiing, scuba diving, or hiking.

- Long-Term Travel: For extended trips or multiple trips throughout the year.

- Travel to Remote Areas: Where medical facilities may be inadequate, and evacuation might be necessary.

Key Differences Between Travel Insurance and Trip Insurance

| Aspect | Trip Insurance | Travel Insurance |

|---|---|---|

| Scope of Coverage | Focuses on protecting financial investment in trip arrangements (cancellations, delays, baggage loss). | Provides broader protection including medical emergencies, evacuation, and trip-related issues. |

| Medical Coverage | Generally does not include medical coverage. | Includes coverage for medical expenses and emergency evacuation. |

| Duration of Coverage | Typically covers a single trip. | Can cover single trips or offer multi-trip/annual plans. |

| Cost | Usually less expensive due to limited coverage scope. | More expensive but offers comprehensive protection. |

Overlap and Interchangeability

It’s important to note that some insurance providers use these terms interchangeably, and the exact coverage can vary between policies. Always read the policy details carefully to understand what is and isn’t covered. Some trip insurance plans may include limited medical coverage, while some travel insurance plans might offer customizable options to suit your specific needs.

Choosing the Right Insurance

When deciding between trip insurance and travel insurance, consider the following factors:

- Destination: If traveling abroad, especially to countries with high medical costs or limited healthcare facilities, comprehensive travel insurance is advisable.

- Trip Cost: For expensive, prepaid trips, ensuring you have trip cancellation and interruption coverage is essential.

- Health Insurance: Check if your existing health insurance covers you abroad. If not, travel insurance with medical coverage is important.

- Activities Planned: For adventurous activities, ensure your policy covers related risks.

- Personal Comfort: Assess your risk tolerance and how much peace of mind you desire during your travels.

Travel and trip insurance offer varying levels of protection for different aspects of a trip. Travel insurance, on one hand, provides coverage for medical emergencies and expenses, trip cancellations or interruptions, lost baggage, and emergency evacuations. It ensures that travelers are financially protected and can access necessary medical care in case of an unforeseen event.

On the other hand, trip insurance primarily focuses on trip cancellations or interruptions, providing coverage for the non-refundable costs of flights, accommodations, or other pre-paid expenses. By understanding the differences between these two types of insurance, travelers can make informed decisions to safeguard their trips and enjoy worry-free journeys.

Key Differences

Between Travel Insurance and Trip Insurance

| Aspect | Trip Insurance | Travel Insurance |

|---|---|---|

| Scope of Coverage | Primarily covers financial aspects of travel plans, such as trip cancellation, interruption, delays, and baggage issues. | Offers broader protection, including all trip insurance coverages plus medical emergencies, evacuation, and accidental death. |

| Medical Coverage | Generally does not include medical or health-related coverage. | Includes coverage for medical expenses, emergency medical evacuation, and sometimes accidental death and dismemberment (AD&D). |

| Purpose | Designed to protect the financial investment in a specific trip, especially if prepaid or non-refundable. | Designed to provide comprehensive protection during travel, particularly for health and safety risks. |

| Duration of Coverage | Typically covers a single trip from start to finish. | Can cover either a single trip or multiple trips over a specified period, such as a year. |

| Cost | Usually less expensive due to more limited coverage. | Typically more expensive due to more extensive coverage, including health and emergency services. |

| Best For | Short-term trips with significant non-refundable costs. | International travel, long-term trips, or trips involving high-risk activities. |

Summary:

- Trip Insurance is best for protecting your financial investment in travel arrangements, such as trip cancellations or interruptions.

- Travel Insurance offers broader protection, including medical coverage and emergency services, making it ideal for international or extended trips

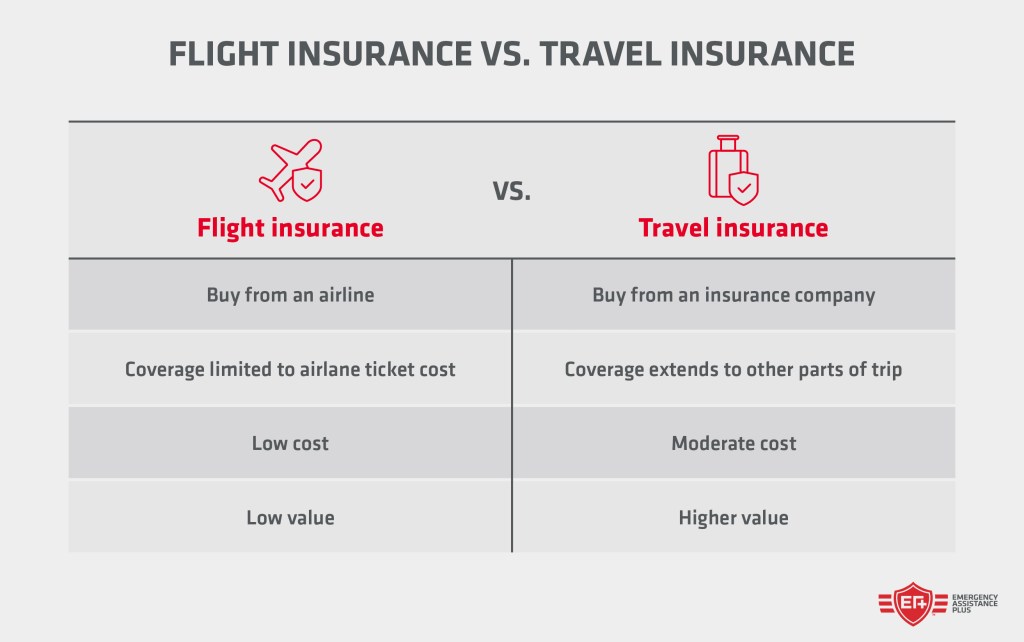

Coverage

Travel insurance typically provides coverage for a wide range of eventualities including trip cancellation, medical emergencies, lost baggage, and travel delays. On the other hand, trip insurance focuses solely on the actual trip and may only cover certain elements such as trip cancellation and interruption.

Duration

Travel insurance is usually purchased for a specific trip or a set period, whereas trip insurance is geared towards protecting the financial investment made in a single trip, usually covering the duration of that particular trip.

Credit: covertrip.com

Travel Insurance

Travel insurance and trip insurance may seem similar, but there are key differences. Travel insurance provides coverage for medical emergencies, trip cancellation, and lost luggage, while trip insurance mainly focuses on trip cancellation and interruption.

Travel insurance is a type of coverage that provides financial protection against certain risks and losses that may occur during a trip. It is designed to provide peace of mind and mitigate unexpected expenses that can arise while traveling. Understanding the key aspects of travel insurance can help you make informed decisions when planning your next adventure.

Definition

Travel insurance is a contract between the policyholder and the insurance provider, where the insurer agrees to cover a specific set of risks and give compensation for any losses incurred while traveling.

Scope

Travel insurance typically covers a wide range of scenarios, including:

- Medical emergencies:

- Trip cancellation or interruption:

- Lost or delayed baggage:

- Travel delays:

- Emergency evacuation:

- Accidental death and dismemberment:

Benefits

Travel insurance offers a variety of benefits that can differ based on the policy and coverage options chosen. Some of the most common benefits include:

- Medical expenses: Travel insurance can provide coverage for medical expenses incurred due to illness or injury while traveling.

- Emergency assistance: In case of emergencies, travel insurance provides access to 24/7 assistance services, including medical referrals, emergency cash transfers, and legal assistance.

- Trip cancellation or interruption: If you are unable to embark on your trip or need to cut it short due to covered reasons such as sickness, injury, or other unforeseen circumstances, travel insurance can reimburse you for the prepaid expenses.

- Baggage and personal belongings: If your luggage is lost, stolen, or damaged during your trip, travel insurance can provide reimbursement for the value of your belongings.

- Travel delays: In the event of flight cancellations or delays, travel insurance can cover additional expenses such as accommodation, meals, and transportation.

- Emergency evacuation: If you need to be medically transported to the nearest appropriate facility or repatriated to your home country, travel insurance can cover the costs.

- Accidental death and dismemberment: Travel insurance provides coverage in the unfortunate event of accidental death or loss of limbs while traveling.

Overall, travel insurance offers invaluable protection and helps travelers navigate unexpected circumstances that may arise during their journeys. By understanding the definition, scope, and benefits of travel insurance, you can make informed decisions to ensure a hassle-free and worry-free travel experience.

Types Of Travel Insurance

When it comes to travel insurance, it’s important to understand the different types of coverage available. Whether you’re planning a vacation or a business trip, having the right insurance can provide peace of mind and protect you from unexpected expenses. In this article, we’ll explore the three main types of travel insurance: Medical Insurance, Cancellation Insurance, and Baggage Insurance.

Medical Insurance

Medical Insurance is one of the most important types of travel insurance because it covers any medical expenses that may arise during your trip. This can include emergency medical treatments, hospital stays, and even medical evacuations. In a foreign country, medical expenses can be costly, and having medical insurance can save you from financial burden. It’s crucial to review the coverage limits and exclusions specific to your policy to ensure you have adequate protection.

Cancellation Insurance

Cancellation Insurance is designed to protect you financially if you need to cancel or postpone your trip due to unforeseen circumstances. These circumstances could include illness or injury, a family emergency, or even a natural disaster. With cancellation insurance, you can recover the non-refundable expenses you have already paid for your trip, such as flights, accommodation, and tours. It’s important to carefully review the policy to understand the covered reasons for cancellation and any applicable deductibles.

Baggage Insurance

Baggage Insurance provides coverage for lost, stolen, or damaged luggage during your trip. It can reimburse you for the value of your lost or damaged belongings, helping you to replace essential items such as clothing, toiletries, or electronics. Additionally, some policies may offer coverage for delayed baggage, providing you with funds to purchase necessary items while you wait for your luggage to arrive. Be sure to review the policy for coverage limits and any unique requirements, such as reporting any loss or theft within a specific timeframe.

Having an understanding of the different types of travel insurance can help you choose the right coverage for your specific needs. Medical insurance ensures that you’re protected in case of any medical emergencies, cancellation insurance can provide reimbursement for non-refundable expenses, and baggage insurance protects your belongings throughout your trip. By selecting the appropriate travel insurance policies, you can have a worry-free journey.

Trip Insurance

Trip Insurance provides travel coverage for a specific trip. It is designed to safeguard against potential financial losses relating to unforeseen situations while traveling. Let’s dive deeper into the details of trip insurance, including its definition, coverage, and benefits.

1. Definition

Definition

Trip insurance is a form of travel insurance that offers protection for a single trip, typically from the time of departure to the time of return. This type of insurance provides coverage for a range of potential events that could disrupt or cancel a trip, including illness, accidents, natural disasters, or other unforeseen circumstances.

2. Coverage

Coverage

Trip insurance typically includes coverage for:

- Trip cancellation or interruption

- Emergency medical expenses during the trip

- Baggage loss or delay

- Travel delay

- Emergency evacuation

This coverage can help travelers recoup their investment in case of unexpected trip cancellations or incidents during travel.

3. Benefits

Benefits

The benefits of trip insurance include:

- Peace of mind knowing that financial losses due to trip cancellation or interruption can be mitigated

- Assistance with emergency medical expenses while traveling

- Reimbursement for lost or delayed luggage

- Coverage for expenses incurred due to travel delays

- Access to emergency evacuation services in case of unforeseen medical emergencies

By providing these benefits, trip insurance allows travelers to enjoy their trips with added security and protection.

When To Choose Travel Insurance

Travel insurance and trip insurance may sound similar, but there is a difference. Travel insurance typically covers a wider range of events and situations, such as trip cancellation, medical emergencies, and lost baggage, while trip insurance focuses mainly on trip cancellation or interruption.

It’s important to consider your specific needs and travel plans when choosing insurance coverage.

Choosing the right insurance for your trip can be overwhelming, especially with the plethora of options available. However, travel insurance becomes essential in certain circumstances to provide you with the necessary coverage and peace of mind. Let’s explore when it’s crucial to opt for travel insurance.

International Travel

When embarking on an international trip, travel insurance becomes imperative. International travel involves more risks, including medical emergencies, trip cancellation, lost baggage, and travel document issues. By securing travel insurance, you can safeguard yourself against these unforeseen circumstances.

With travel insurance, you can avail of international medical coverage, ensuring that you have access to medical assistance and full financial protection while traveling abroad. In case of medical emergencies or illnesses, you can receive appropriate treatment without incurring significant expenses.

Moreover, travel insurance offers coverage for trip cancellation or interruption due to reasons such as illness, natural disasters, or unforeseen events. This means you can recover your pre-paid expenses and avoid financial losses that may result from unexpected circumstances.

Adventure Travel

Adventure travel involves activities that are considered higher risk, such as mountain climbing, scuba diving, or zip-lining. While these activities provide exhilarating experiences, they also come with their fair share of hazards. In such cases, travel insurance is vital to protect yourself against potential injuries or accidents.

By opting for adventure travel insurance, you can ensure that you are covered for medical emergencies related to adventurous activities. This includes coverage for medical evacuation, hospital expenses, and repatriation, should the need arise.

Credit: www.emergencyassistanceplus.com

When To Choose Trip Insurance

Having a travel insurance plan can provide peace of mind and protect you financially in case of unexpected events during your trip. However, there are specific situations where trip insurance becomes indispensable. Let’s explore some scenarios where you should consider opting for trip insurance.

Domestic Travel

If you are planning a domestic trip within your own country, you might think that trip insurance is unnecessary. However, unforeseen issues can still arise even when traveling closer to home. Trip insurance can be beneficial in case you need to cancel or postpone your trip due to unexpected events such as illness, accidents, or natural disasters. Additionally, it can provide coverage for lost luggage, trip delays, or medical emergencies that may occur during your domestic travel.

Prepaid Expenses

If you have made significant prepaid expenses for your trip, such as non-refundable hotel reservations, flight tickets, or tour packages, it is wise to consider trip insurance. This coverage can protect you financially if you need to cancel your trip due to a covered reason, ensuring that you do not lose the money you have already spent. Without trip insurance, you may be left with hefty cancellation fees and no reimbursement for your prepaid expenses.

In conclusion, trip insurance is essential when you are making prepaid expenses for your trip or traveling domestically. It provides valuable protection against unexpected events and ensures that you can enjoy your trip with greater peace of mind. Remember to carefully review the policy and coverage options before selecting a trip insurance plan tailored to your specific needs.

Understanding the differences between travel insurance and trip insurance helps you make an informed decision to protect yourself and your investment while traveling. Always compare different policies, check the coverage details, and choose a plan that best fits your travel plans and personal needs.

Choosing The Right Coverage

When it comes to planning a trip, one of the most important decisions you will make is choosing the right coverage for your travels. Understanding the difference between travel insurance and trip insurance, and how to select the appropriate coverage, can save you from potential headaches and financial losses. Below, we’ll discuss the key factors to consider when choosing the right coverage for your travels.

Consider Your Needs

Before purchasing any type of insurance, it’s essential to assess your individual needs and the specific risks associated with your trip. Consider your travel destination, the duration of your trip, any pre-existing medical conditions, and the activities you plan to participate in. Determine whether you require coverage for trip cancellations, medical emergencies, lost baggage, or other potential mishaps. By understanding your needs, you can make an informed decision about the type and level of coverage that is right for you.

Compare Plans

Once you’ve defined your needs, it’s time to compare the available insurance plans. Assess the coverage limits, deductibles, exclusions, and additional benefits offered by each plan. Consider the reputation and financial stability of the insurance providers to ensure they can fulfill their obligations in the event of a claim. Review the policy wording and ask any questions to clarify any uncertainties. By comparing plans thoroughly, you can choose the one that offers the most suitable and comprehensive coverage for your trip.

Credit: www.visitorscoverage.com

Frequently Asked Questions Of What Is The Difference Between Travel And Trip Insurance

What Is Travel Insurance?

Travel insurance is a type of insurance that covers unexpected events or emergencies that may occur during a trip, such as cancelled flights, lost luggage, or medical emergencies.

What Is Trip Insurance?

Trip insurance, also known as trip cancellation insurance, provides coverage for non-refundable travel expenses if your trip is cancelled, interrupted, or delayed. It can also offer medical coverage while traveling.

What Is The Difference Between Travel And Trip Insurance?

While both travel and trip insurance are designed to protect travelers, the main difference lies in their coverage. Travel insurance is more comprehensive and covers a wide range of unexpected events, while trip insurance is focused on protecting your investment and providing trip-related coverage.

Conclusion

In the end, understanding the differences between travel and trip insurance is important. As you plan your next adventure, knowing the specific coverage each type offers can help you make informed decisions. Whether it’s protecting your trip costs or your health while abroad, choosing the right insurance can provide peace of mind as you explore the world.