Travel Trip Insurance Works by providing coverage for unforeseen events and expenses that may occur before or during a trip, such as trip cancellations, medical emergencies, and lost luggage. With travel trip insurance, travelers can have peace of mind knowing they are protected against financial losses in case of unexpected situations.

Planning for the unexpected is crucial when it comes to travel, and travel trip insurance ensures that travelers are safeguarded against potential risks, allowing them to fully enjoy their journeys.

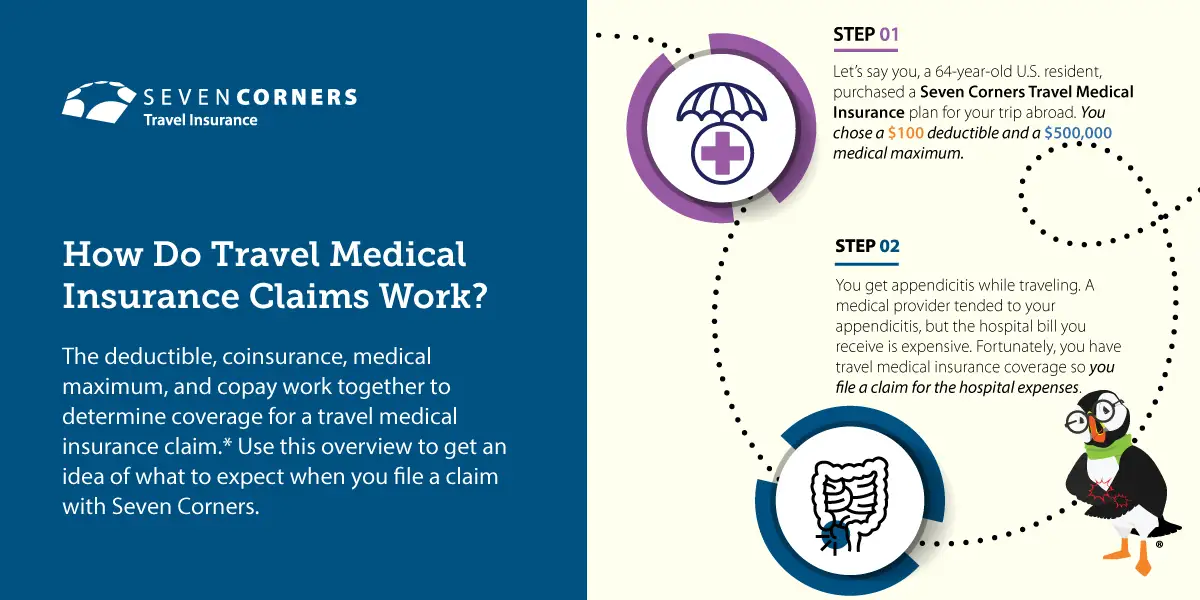

Travel trip insurance is designed to protect travelers from financial losses and disruptions caused by unexpected events. It works by offering various types of coverage that can be activated when unforeseen circumstances impact your travel plans. Here’s a detailed look at how travel trip insurance provides coverage for these unforeseen events:

Types of Coverage for Unforeseen Events

1. Trip Cancellation

- How It Works: If you need to cancel your trip due to unforeseen events like illness, injury, death of a family member, natural disasters, or other covered reasons, trip cancellation insurance reimburses you for non-refundable expenses such as flights, hotels, and tours.

- Example: If you fall ill before your trip and your doctor advises against traveling, you can cancel your trip and claim the non-refundable costs.

2. Trip Interruption

- How It Works: If your trip is cut short due to covered reasons like a family emergency or severe weather, trip interruption insurance covers the additional costs to return home and reimburses you for the unused portion of your trip.

- Example: If a family member becomes seriously ill while you are on your trip, trip interruption insurance will cover the cost of returning home early and any prepaid expenses for the unused part of the trip.

3. Medical Expenses

- How It Works: This coverage pays for medical and dental expenses if you become ill or injured while traveling. It often includes hospital stays, doctor visits, and medication costs.

- Example: If you suffer an injury while traveling abroad and need emergency medical treatment, your travel insurance will cover the medical bills up to the policy limits.

4. Emergency Evacuation

- How It Works: If you need to be transported to the nearest medical facility or back home due to a medical emergency, emergency evacuation coverage handles these costs.

- Example: If you are hiking in a remote area and suffer a severe injury, emergency evacuation coverage will cover the cost of helicopter transport

Credit: www.sevencorners.com

Different Types Of Travel Trip Insurance

Travel trip insurance comes in various forms, each designed to address specific risks and provide coverage for different aspects of your journey. Understanding the different types of travel trip insurance can help you choose the right policy for your needs. Here’s an overview of the main types of travel trip insurance:

1. Trip Cancellation Insurance

Coverage:

- Reimburses non-refundable, prepaid expenses if you need to cancel your trip due to covered reasons such as illness, injury, death of a family member, natural disasters, or other specified events.

Benefits:

- Protects your financial investment in the trip.

- Covers costs such as flights, hotels, tours, and other prepaid expenses.

Example:

- If you or a close family member falls ill before your trip and you have to cancel, trip cancellation insurance can cover the costs of flights, hotels, and tours that you cannot get refunded.

2. Trip Interruption Insurance

Coverage:

- Covers additional expenses if your trip is cut short due to covered reasons, including return travel expenses and reimbursement for unused portions of your trip.

Benefits:

- Provides financial protection if you have to end your trip early.

- Covers costs of returning home and unused travel arrangements.

Example:

- If you have to return home early because of a family emergency, trip interruption insurance will cover the cost of your early flight home and the non-refundable portion of your trip.

3. Medical Expense Insurance

Coverage:

- Pays for medical and dental expenses if you become ill or injured while traveling.

Benefits:

- Ensures access to medical care without incurring significant out-of-pocket expenses.

- Can include hospital stays, doctor visits, and medication costs.

Example:

- If you suffer an injury while traveling abroad and need emergency medical treatment, your travel insurance will cover the medical bills up to the policy limits.

4. Emergency Evacuation and Repatriation Insurance

Coverage:

- Provides for emergency transportation to the nearest suitable medical facility or back home if necessary due to a medical emergency.

Benefits:

- Covers costs of emergency medical transport, which can be very expensive.

- Ensures you receive appropriate medical care quickly.

Example:

- If you are in a remote area and need urgent medical attention, emergency evacuation coverage will cover the cost of airlifting you to the nearest hospital.

5. Baggage and Personal Belongings Insurance

Coverage:

- Reimburses you for personal belongings that are lost, stolen, or damaged.

- Covers the cost of essential items if your baggage is delayed.

Benefits:

- Provides compensation for lost, stolen, or damaged items.

- Covers essential expenses if baggage is delayed.

Example:

- If your luggage is delayed for more than 24 hours, your insurance can cover the cost of purchasing necessary items like clothing and toiletries.

6. Travel Delay Insurance

Coverage:

- Covers additional expenses if your trip is delayed for a specified amount of time due to covered reasons such as severe weather, mechanical breakdowns, or strikes.

Benefits:

- Reimburses costs for meals, accommodations, and other expenses incurred due to travel delays.

Example:

- If your flight is delayed overnight due to a snowstorm, travel delay coverage can pay for hotel accommodation and meals.

7. Accidental Death and Dismemberment Insurance (AD&D)

Coverage:

- Provides a lump sum payment to you or your beneficiaries if you suffer a severe injury or death as a result of an accident during your trip.

Benefits:

- Offers financial support in the event of a serious accident.

- Can help cover costs related to accidental injury or death.

Example:

- If you are involved in a serious accident while traveling and suffer a significant injury, AD&D insurance will provide a payout to help with medical costs and other expenses.

8. Rental Car Insurance

Coverage:

- Covers damage or theft of a rental car.

- May include liability coverage for damage to other vehicles or property.

Benefits:

- Protects against high repair costs for rental vehicles.

- Provides peace of mind when renting a car during your trip.

Example:

- If you are involved in a minor accident with your rental car, rental car insurance will cover the repair costs.

9. Cancel for Any Reason (CFAR) Insurance

Coverage:

- Allows you to cancel your trip for any reason not covered by the standard policy and receive partial reimbursement (typically 50-75%).

Benefits:

- Provides flexibility to cancel your trip for any reason.

- Offers broader protection than standard trip cancellation insurance.

Example:

- If you decide to cancel your trip because you no longer feel comfortable traveling, CFAR insurance will reimburse a portion of your trip costs.

When it comes to planning a trip, it is essential to consider travel trip insurance to protect yourself from unforeseen circumstances. There are different types of travel trip insurance designed to cater to various travel needs, from domestic trips to international journeys.

Domestic Trip Insurance

Domestic trip insurance provides coverage for travels within the traveler’s home country. It typically includes benefits such as trip cancellation, trip interruption, baggage loss, and medical expenses. This type of insurance is ideal for individuals planning short getaways or business trips within their own country.

International Trip Insurance

International trip insurance is tailored for journeys outside the traveler’s home country. It encompasses a broader scope of coverage, including emergency medical evacuation, repatriation of remains, and coverage for travel delays. This type of insurance is essential for those embarking on vacations, study abroad programs, or international business trips.

Coverage Of Travel Trip Insurance

Travel trip insurance provides a range of coverages to protect travelers from financial losses and inconveniences due to unexpected events. Here’s a comprehensive look at the key coverages offered by travel trip insurance:

1. Trip Cancellation

Coverage:

- Reimburses prepaid, non-refundable expenses if you need to cancel your trip due to covered reasons.

Covered Reasons:

- Illness or injury (of you or a traveling companion).

- Death of a family member.

- Natural disasters or severe weather affecting your destination.

- Jury duty or court subpoenas.

- Military deployment or civil unrest.

- Travel carrier financial default.

Example:

- If you or a close family member falls ill before your trip and you have to cancel, trip cancellation insurance can cover the costs of flights, hotels, and tours that you cannot get refunded.

2. Trip Interruption

Coverage:

- Covers additional expenses if your trip is cut short due to covered reasons.

Covered Reasons:

- Similar to trip cancellation: illness, injury, death, natural disasters, etc.

Example:

- If you have to return home early because of a family emergency, trip interruption insurance will cover the cost of your early flight home and the non-refundable portion of your trip.

3. Medical Expense

Coverage:

- Pays for medical and dental expenses if you become ill or injured while traveling.

Covered Costs:

- Hospital stays.

- Doctor visits.

- Prescription medications.

- Emergency dental treatment.

Example:

- If you suffer an injury while traveling abroad and need emergency medical treatment, your travel insurance will cover the medical bills up to the policy limits.

4. Emergency Evacuation and Repatriation

Coverage:

- Provides for emergency transportation to the nearest suitable medical facility or back home if necessary.

Covered Situations:

- Medical emergencies requiring immediate transport.

- Transportation of remains in case of death.

Example:

- If you are in a remote area and need urgent medical attention, emergency evacuation coverage will cover the cost of airlifting you to the nearest hospital.

5. Baggage and Personal Belongings

Coverage:

- Reimburses you for personal belongings that are lost, stolen, or damaged.

- Covers the cost of essential items if your baggage is delayed.

Covered Items:

- Luggage.

- Personal items (clothing, electronics, etc.).

- Essential purchases if baggage is delayed (toiletries, clothing).

Example:

- If your luggage is delayed for more than 24 hours, your insurance can cover the cost of purchasing necessary items like clothing and toiletries.

6. Travel Delay

Coverage:

- Covers additional expenses if your trip is delayed for a specified amount of time due to covered reasons.

Covered Expenses:

- Meals.

- Hotel accommodations.

- Transportation.

Example:

- If your flight is delayed overnight due to a snowstorm, travel delay coverage can pay for hotel accommodation and meals.

7. Accidental Death and Dismemberment (AD&D)

Coverage:

- Provides a lump sum payment to you or your beneficiaries if you suffer a severe injury or death as a result of an accident during your trip.

Covered Situations:

- Death.

- Loss of limb(s).

- Loss of sight, speech, or hearing.

Example:

- If you are involved in a serious accident while traveling and suffer a significant injury, AD&D insurance will provide a payout to help with medical costs and other expenses.

8. Rental Car Insurance

Coverage:

- Covers damage or theft of a rental car.

- May include liability coverage for damage to other vehicles or property.

Covered Situations:

- Collision.

- Theft.

- Vandalism.

Example:

- If you are involved in a minor accident with your rental car, rental car insurance will cover the repair costs.

9. Cancel for Any Reason (CFAR)

Coverage:

- Allows you to cancel your trip for any reason not covered by the standard policy and receive partial reimbursement (typically 50-75%).

Example:

- If you decide to cancel your trip because you no longer feel comfortable traveling, CFAR insurance will reimburse a portion of your trip costs.

Additional Coverages

1. Missed Connection

- Coverage for additional expenses incurred due to missing a connecting flight or other transport due to reasons beyond your control.

2. Travel Accident Insurance

- Coverage for accidental death or injury during your trip, separate from AD&D.

Travel trip insurance provides coverage for various aspects of your trip, ensuring that you have financial protection and peace of mind while traveling. Understanding the coverage offered by travel trip insurance is essential to make the most out of your policy. Let’s explore the different types of coverage that travel trip insurance typically includes:

Trip Cancellation Or Interruption Coverage

Unforeseen circumstances can sometimes force you to cancel or cut short your trip. Trip cancellation or interruption coverage helps you recover some or all of the non-refundable expenses you incurred before your trip was canceled or interrupted. This coverage typically includes reimbursement for prepaid, non-refundable expenses such as plane tickets, hotel reservations, and tour packages.

Medical Expenses Coverage

When you travel, it’s crucial to prioritize your health. Medical expenses coverage ensures that you are protected in case you need medical treatment while traveling. This coverage is particularly important when you are traveling internationally, as medical costs in other countries can be significantly higher than what you may be accustomed to. With medical expenses coverage, you can seek medical treatment without worrying about the financial burden.

Baggage And Personal Belongings Coverage

Losing your baggage or having your personal belongings stolen during a trip can be a frustrating and disheartening experience. Baggage and personal belongings coverage provides financial protection in case your luggage is lost, damaged, or stolen. This coverage typically includes reimbursement for the value of the lost items, allowing you to replace them and continue enjoying your trip.

Having a comprehensive understanding of the coverage offered by travel trip insurance is essential before embarking on your journey. Whether it’s trip cancellation or interruption coverage, medical expenses coverage, or baggage and personal belongings coverage, having the right insurance protection ensures that you can enjoy your trip worry-free.

Travel trip insurance offers a wide range of coverages to address various risks and unexpected events that can occur before or during your trip. Understanding these coverages helps ensure you choose a policy that best meets your needs, providing financial protection and peace of mind throughout your travels.

When Should You Buy Travel Trip Insurance?

When Should You Buy Travel Trip Insurance?

Travel trip insurance is an essential aspect of any trip planning, providing financial protection and peace of mind during unforeseen circumstances. Understanding when to buy travel trip insurance is crucial to maximize its benefits. Here are two key moments to consider when purchasing travel trip insurance:

Booking A Trip

When you book a trip, it is wise to consider purchasing travel trip insurance as early as possible. By doing so, you can ensure coverage for any unexpected events that may arise before your departure. This includes situations like trip cancelation due to illness, accidents, or severe weather conditions. Buying travel trip insurance during this stage will provide you with comprehensive coverage, protecting your investment in booking flights, accommodations, and other travel expenses.

Before Departure

Prior to your departure date, it is essential to have travel trip insurance in place. At this stage, unexpected events such as sudden illness, accidents, or family emergencies may force you to alter or cancel your travel plans. Without insurance, you could potentially incur significant financial losses. However, by purchasing travel trip insurance before departure, you can safeguard yourself against such risks. This ensures that you can recover your non-refundable expenses and potentially avoid last-minute inconveniences.

In conclusion, purchasing travel trip insurance at the time of booking and before departure offers you comprehensive coverage and peace of mind, protecting you financially from unexpected events and allowing you to enjoy your trip stress-free.

Credit: www.chase.com

Factors To Consider Before Purchasing Travel Trip Insurance

Travel trip insurance can provide valuable protection and peace of mind during your travels, but choosing the right policy requires careful consideration of several factors. Here’s a comprehensive guide to the key factors to consider before purchasing travel trip insurance:

1. Type of Coverage Needed

a. Trip Cancellation and Interruption

- Consider if: You have made significant non-refundable payments for your trip.

- Benefits: Protects against financial loss if you need to cancel or cut short your trip due to covered reasons.

b. Medical and Health Coverage

- Consider if: You are traveling abroad where your domestic health insurance may not be valid.

- Benefits: Covers medical expenses and emergency evacuation, providing access to necessary medical care without significant out-of-pocket costs.

c. Baggage and Personal Belongings

- Consider if: You are traveling with valuable items or have concerns about lost or delayed luggage.

- Benefits: Reimburses you for lost, stolen, or damaged items and covers essential purchases if your baggage is delayed.

d. Travel Delay

- Consider if: Your travel plans include tight connections or you are traveling during a season prone to weather delays.

- Benefits: Covers additional expenses for meals, accommodations, and transportation if your trip is delayed.

e. Accidental Death and Dismemberment (AD&D)

- Consider if: You want additional coverage for severe accidents resulting in injury or death.

- Benefits: Provides a lump sum payment to you or your beneficiaries in the event of an accident.

2. Duration and Frequency of Travel

- Single Trip Insurance: Best for one-time travelers or those taking infrequent trips.

- Annual Multi-Trip Insurance: Suitable for frequent travelers, covering multiple trips within a year.

- Consider: The length of each trip and the total number of trips planned within a year.

3. Destination

- Domestic vs. International: Coverage needs may vary based on whether you are traveling domestically or internationally.

- Risk Level: Some destinations may have higher risks due to political instability, natural disasters, or health concerns, affecting the type of coverage you need.

4. Activities Planned

- Adventure and Sports: If you plan on engaging in high-risk activities such as skiing, scuba diving, or hiking, ensure the policy covers these activities or consider purchasing additional coverage.

- Standard vs. Hazardous Activities: Standard policies may not cover injuries from hazardous activities without additional premiums.

5. Policy Exclusions

- Common Exclusions: Pre-existing medical conditions, travel undertaken against medical advice, participation in hazardous activities, and acts of war or terrorism.

- Pre-existing Condition Waiver: Check if you can obtain a waiver for pre-existing conditions to ensure coverage.

- Read the Fine Print: Understand all exclusions and limitations of the policy to avoid surprises during a claim.

6. Cost of the Policy

- Premium Amount: Compare premiums of different policies to find a balance between cost and coverage.

- Deductibles: Consider the deductibles and how they affect your out-of-pocket expenses in the event of a claim.

- Coverage Limits: Ensure the policy provides adequate coverage limits for your needs, such as high enough medical expense limits for international travel.

7. Insurance Provider Reputation

- Customer Reviews: Look for reviews and ratings of the insurance provider to gauge customer satisfaction.

- Financial Stability: Choose a provider with strong financial ratings to ensure they can pay out claims.

- Claims Process: Understand the claims process, including how easy it is to file a claim and the average turnaround time for claims to be paid.

8. Ease of Purchase and Management

- Online Purchase: Check if you can easily purchase the policy online and manage it through a digital platform.

- Customer Service: Ensure the provider offers reliable customer service for questions and assistance before and during your trip.

9. Optional Add-ons and Customization

- Cancel for Any Reason (CFAR): Provides flexibility to cancel your trip for any reason not covered by the standard policy.

- Rental Car Coverage: Additional coverage for rental car damage or theft.

- Business Equipment: Coverage for business travelers carrying essential equipment.

- Consider: Whether you need any optional add-ons to tailor the policy to your specific needs.

Before purchasing travel trip insurance, it’s essential to carefully consider various factors that can greatly impact the coverage and benefits you receive. By evaluating these key aspects, you can make an informed decision about the most suitable insurance for your travel needs.

Trip Duration

When selecting travel trip insurance, it’s crucial to assess the duration of your trip. Short-term coverage is ideal for brief vacations, while an extended trip may require long-term insurance to ensure comprehensive protection throughout your entire journey.

Destination

The destination plays a significant role in determining the type of travel trip insurance you should opt for. International travel often necessitates insurance with global coverage, while domestic trips may only require local or regional insurance policies.

Travel Activities

Consider the activities you plan to engage in during your travels. Adventure sports, extreme recreational pursuits, or hazardous activities may demand specialized insurance coverage. It’s vital to ensure that your travel trip insurance meets the specific requirements of the activities you intend to participate in.

Steps To Get Travel Trip Insurance

Purchasing travel trip insurance is a straightforward process that involves several key steps to ensure you get the right coverage for your needs. Here’s a step-by-step guide to help you through the process:

1. Assess Your Travel Needs

Consider:

- Destination: Domestic or international travel, and any specific risks associated with the destination.

- Duration: Length of your trip and if you need single-trip or multi-trip coverage.

- Activities: Any high-risk activities planned, such as adventure sports or hiking.

- Health Needs: Existing medical conditions and the level of medical coverage required.

2. Research Insurance Providers

Look For:

- Reputation: Check customer reviews and ratings for reliability and service quality.

- Financial Stability: Ensure the provider is financially stable to handle claims.

- Customer Service: Look for providers with responsive and helpful customer service.

3. Compare Insurance Policies

Key Factors:

- Coverage Types: Compare the types of coverage offered (trip cancellation, medical expenses, baggage loss, etc.).

- Coverage Limits: Ensure the policy provides adequate coverage limits for your needs.

- Exclusions: Understand what is excluded from the policy.

- Cost: Compare premiums and deductibles.

4. Get Quotes

Steps:

- Online Quotes: Use insurance comparison websites or visit provider websites to get quotes.

- Information Required: Provide details about your trip, including dates, destination, and personal information.

- Multiple Quotes: Obtain quotes from several providers to compare.

5. Evaluate Policy Details

Consider:

- Fine Print: Read the terms and conditions carefully.

- Exclusions: Note any exclusions that could affect your coverage.

- Claims Process: Understand how to file a claim and the required documentation.

- Optional Add-ons: Consider any optional add-ons like Cancel for Any Reason (CFAR) or rental car coverage.

6. Purchase the Policy

Steps:

- Select Policy: Choose the policy that best meets your needs and budget.

- Complete Application: Fill out the application form with accurate information.

- Payment: Pay the premium using the available payment methods (credit card, bank transfer, etc.).

- Confirmation: Ensure you receive a confirmation email or document with your policy details.

7. Review and Save Policy Documents

Ensure:

- Policy Number: Keep your policy number and customer service contact information handy.

- Coverage Summary: Review the coverage summary to understand your benefits and limits.

- Save Documents: Print or save digital copies of your policy documents for easy access during your trip.

8. Inform Relevant Parties

Steps:

- Travel Companions: Inform your travel companions about your insurance details.

- Emergency Contacts: Provide a copy of your policy to a trusted friend or family member in case of an emergency.

9. Know the Claims Process

Prepare:

- Documentation: Keep all receipts, medical reports, and other relevant documents during your trip.

- Contact Information: Have the insurance provider’s emergency contact information available.

- File Promptly: File any claims as soon as possible with all required documentation.

When planning a trip, it’s important to consider the unexpected. Travel trip insurance provides coverage against unexpected events like trip cancellations, medical emergencies, or lost luggage, ensuring you have peace of mind throughout your journey. To get travel trip insurance, follow these simple steps:

Research Providers

Start by researching reputable travel insurance providers. Look for companies with a good track record, positive customer reviews, and comprehensive coverage options. Consider factors like coverage limits, deductibles, and the specific events covered by each policy. Comparing multiple providers will help you find the one that best suits your needs.

Compare Quotes

After you’ve identified a few potential providers, obtain quotes for the desired coverage. Use online tools or contact the insurance companies directly to get quotes tailored to your specific requirements. Compare the costs and benefits offered by each to make an informed decision. Remember, the cheapest option may not always provide the most comprehensive coverage.

Review Policy Details

Before making a final decision, carefully review the policy details of the insurance companies you are considering. Pay attention to the coverage limits, exclusions, and any additional benefits provided. Familiarize yourself with the terms and conditions of the policy to ensure it aligns with your travel plans and personal circumstances. Highlight important sections, such as emergency medical coverage or trip cancellation benefits.

Purchase

Once you have selected the most suitable policy, it’s time to make the purchase. Contact the insurance provider directly or visit their website to initiate the buying process. Follow the instructions provided and provide the necessary information, such as trip dates and personal details, to complete the purchase. Make sure you understand how to access your policy documents and contact the provider in case of emergencies.

Getting travel trip insurance is a crucial step in protecting yourself and your trip from unexpected events. By researching providers, comparing quotes, reviewing policy details, and making a purchase, you can ensure that you have the right coverage for your travel needs.

Credit: www.travelers.com

Frequently Asked Questions Of How Does Travel Trip Insurance Work

How Does Travel Trip Insurance Work?

Travel trip insurance provides coverage for unexpected events that may disrupt or cancel your trip, such as medical emergencies, trip delays, or lost luggage. It ensures you are financially protected and can have peace of mind while traveling.

What Does Travel Trip Insurance Typically Cover?

Travel trip insurance typically covers trip cancellation or interruption, medical expenses, emergency medical evacuation, baggage loss or delay, and travel delays or missed connections. It is important to review the policy to understand the specific coverage details and exclusions.

When Should I Purchase Travel Trip Insurance?

It is recommended to purchase travel trip insurance as soon as you make your initial trip deposit. This ensures coverage for any unexpected events that may occur before your departure, such as illness or unforeseen circumstances. Purchasing early also allows you to take advantage of the pre-existing condition waiver, if applicable.

Conclusion

In a nutshell, travel trip insurance is a safeguard against unexpected setbacks during your travels. It offers peace of mind by covering medical expenses, trip cancellations, and other unforeseen events. Understanding how travel insurance works ensures you can enjoy your travels worry-free, knowing you have reliable protection.

With the right coverage, you can focus on making unforgettable memories.